Featured

GPO Cartels – Risking Innovation, Inflating Cost, and Killing Patients

By Phillip Zweig

By Phillip Zweig

USA

November 8, 2021

November 8, 2021

Our exclusive Interview with Phillip L. Zweig the award-winning financial journalist and author.

|

"...GPOs are buying exclusivity at the risk of innovation, at the risk of cost, at the risk of lives of patients,”

Makan Delrahim, JD, Former Assistant Attorney General, United States |

“It’s hard to measure the impact of the GPO barrier in discouraging entrepreneurs and inventors to develop innovative medical technologies. It’s allowed because the GPO/hospital lobby and their allies have bought and/or intimidated the United States Congress,”

Phillip Zweig, Journalist & Author |

Yisrael Safeek: Thank you Phil for joining. At a recent US Senate Antitrust Subcommittee oversight hearing on the anticompetitive practices of hospital group purchasing organizations (GPOs), Justice Department Antitrust Chief Makan Delrahim said that "...GPOs are buying exclusivity at the risk of innovation, at the risk of cost, at the risk of lives of patients." When GPOs first rose to prominence in the 1980s, they were supposed to be negotiating pricing terms with suppliers on behalf of providers. You have referred to GPOs as ‘a complete scam legalized by Congress.’ How so?

Phillip Zweig: As we discussed, the first GPO was founded in 1910 when NYC’s Bellevue and a few other hospitals banded together to save money by buying supplies in bulk. It was a co-op, like the Harvard co-op, dairy co-ops etc. in which members paid dues to cover admin expenses. Worked fine for more than 80 years. It was a win-win.

Then in the mid-1980s, hospital/GPO lobbyists sold Congress a bill of goods that more money would be saved if vendors paid admin costs instead of the hospitals. As one of those lobbyists acknowledged to me, one objective was to codify what was already going on. GPOs were already getting kickbacks from vendors.

So, in 1987 Congress awarded GPOs a “Get out of jail free card,” which took the form of an amendment to the Social Security Act, exempting GPOs from criminal prosecution for taking kickbacks. In any other industry, people can and do go to jail for this.

Editor: Check it out

Phillip Zweig: As we discussed, the first GPO was founded in 1910 when NYC’s Bellevue and a few other hospitals banded together to save money by buying supplies in bulk. It was a co-op, like the Harvard co-op, dairy co-ops etc. in which members paid dues to cover admin expenses. Worked fine for more than 80 years. It was a win-win.

Then in the mid-1980s, hospital/GPO lobbyists sold Congress a bill of goods that more money would be saved if vendors paid admin costs instead of the hospitals. As one of those lobbyists acknowledged to me, one objective was to codify what was already going on. GPOs were already getting kickbacks from vendors.

So, in 1987 Congress awarded GPOs a “Get out of jail free card,” which took the form of an amendment to the Social Security Act, exempting GPOs from criminal prosecution for taking kickbacks. In any other industry, people can and do go to jail for this.

Editor: Check it out

|

"I compare GPOs to the fable of Billy Goat Gruff. Vendors have to pay the toll to the troll (GPOs) to cross the bridge and enter the marketplace."

|

See my slide presentation on the website for a graphic comparison of the original co-op GPO model with the 1987 “safe harbor,” pay-to-play model.

The HHS IG was designated by Congress to write and issue to rules governing the safe harbor and monitor compliance. It has been a totally ineffective regulator, to say the least. The rules implementing it went into effect in 1991. They’re posted on the “Legal Background” page of our website. The GPO safe harbor turned GPOs into a “legalized fraud.” Suddenly, instead of seeking to save money for hospitals - the original and sole purpose of GPOs - GPOs sought to increase revenue from vendors. |

Since GPO “fees” (kickbacks) are calculated as a percentage of sales (price X units sold), higher prices translate into more money for GPOs and their executives. Since drugs, devices and supplies (stuff) are the second largest component of hospital costs after labor/salaries, GPOs have contributed in a major way to inflated health care costs. See my “safe harbor analysis,” which I included in comments to the FDA and HHS in response to their requests for comment on drug shortages and a proposal to rescind the safe harbor for PBM Medicare and Medicaid plans, respectively. This rule change was proposed by HHS Secy Alex Azar in January but was killed by the WH a month or so ago. Azar’s proposal was a step in the right direction.

YS: Former U.S. Sen. Herbert Kohl (D-Wis.), then chair of the Subcommittee on Antitrust, Business Rights, and Competition, described GPOs as “a powerful gatekeeper who can cut off competition and squeeze out innovation.” Was he right?

PZ: Sen. Kohl was right on. He championed this issue from 2002 until he retired. So did Sen. DeWine until he lost re-election in 2006.

YS: Former U.S. Sen. Herbert Kohl (D-Wis.), then chair of the Subcommittee on Antitrust, Business Rights, and Competition, described GPOs as “a powerful gatekeeper who can cut off competition and squeeze out innovation.” Was he right?

PZ: Sen. Kohl was right on. He championed this issue from 2002 until he retired. So did Sen. DeWine until he lost re-election in 2006.

|

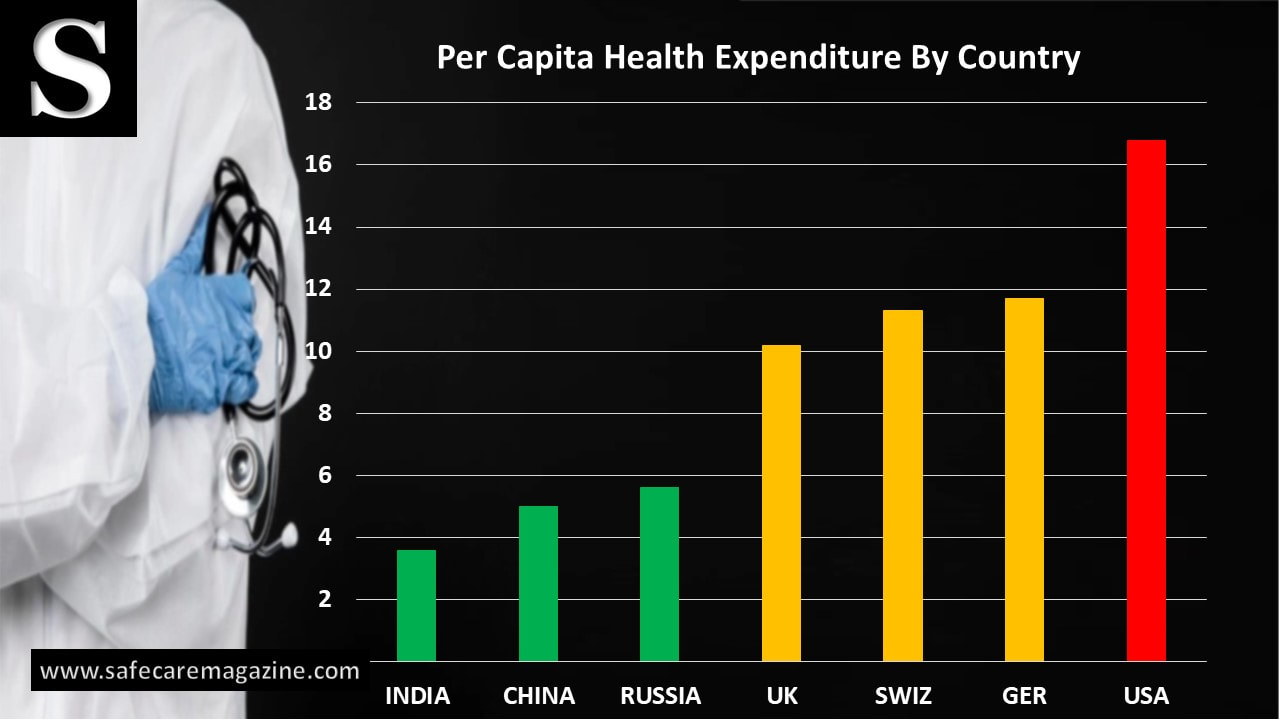

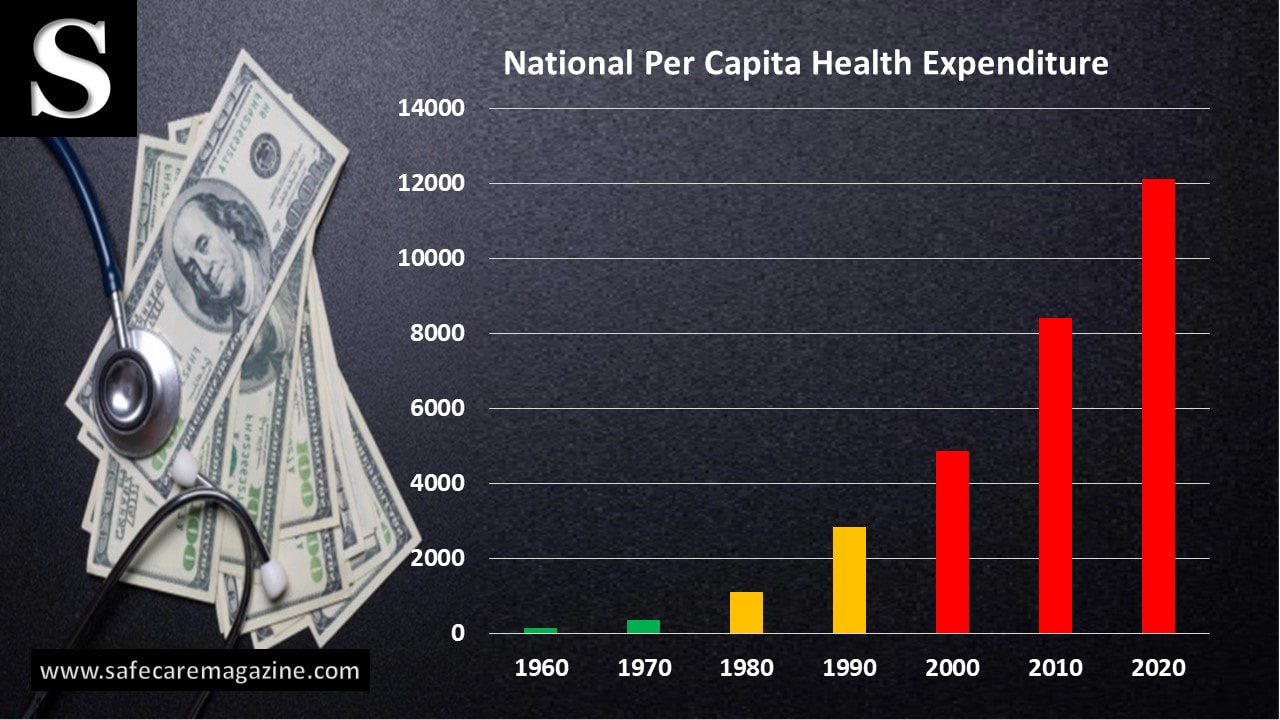

YS: Why has healthcare expenditure increase close to 1500% since GPOs?

PZ: I reviewed all the empirical studies and anecdotal evidence of the cost impact of the safe harbor over about 20 years and estimated that the safe harbor inflated drug/device/supply costs by at least 30% annually, or upwards of $100 billion. In its November 2018 cover article, entitled “Medical Monopoly," DBusiness quoted a supply chain expert as saying that my estimate was too low. In 2003, HHS IG extended GPO safe harbor protection to PBM rebates (a post-sale kickback), giving rise to outrageous prices for drugs sold through PBMs. I estimate that the safe harbor has inflated these outlays by another $130 billion annually. |

"Since GPO “fees” (kickbacks) are calculated as a percentage of sales, higher prices translate into more money for GPOs and their executives."

|

|

"Suddenly, instead of seeking to save money for hospitals - the original and sole purpose of GPOs - GPOs sought to increase revenue from vendors."

|

YS: Are GPOs simply a middle man that provide access to contracts?

PZ: Under the safe harbor, GPOs became nothing more than a gatekeeper. GPOs literally sell market share to the highest bidder in the form of sole-source contracts. They perform no medically, socially, financially useful function. All they do is enrich GPO/hospital insiders, who use some of the kickbacks for political contributions to keep the scam going. I compare GPOs to the fable of Billy Goat Gruff. Vendors have to pay the toll to the troll (GPOs) to cross the bridge and enter the marketplace. |

|

YS: Is there any difference between healthcare GPOs and the mafia in construction industries?

PZ: To supply chain insiders, GPOs are known as the “medical mafia.” There are many similarities between the modus operandi of GPOs and organized crime in the construction industry. See “Corruption and Racketeering in the New York City Construction Industry” by Ronald Goldstock et al, NYU Press, 1990. In effect, GPOs extort outrageous kickbacks from vendors in return for sole source contracts. It’s “legalized racketeering.” Like the mafia, the GPO has conducted a campaign of threats and intimidation against individuals and organizations, notably PADS, that have dared to criticize this industry publicly. They launched a website to disparage us as a “fringe” group and have set up other bogus websites to do likewise. There’s little doubt that they’re funding the harassment campaign against us by a would-be “investigative” website called “Checks and Balances.” It’s run by a washed-up Wall St. flack named Scott Peterson. |

"GPOs are known as the “medical mafia.” Under the safe harbor, GPOs became nothing more than a gatekeeper. GPOs literally sell market share to the highest bidder in the form of sole-source contracts."

|

YS: Why are contract prices closer to the ceiling in the market as opposed to the floor?

PZ: GPOs hire academics and consulting firms to produce “sponsored research studies” claiming that they save billions for hospitals. There is, however, absolutely no independent evidence that GPOs save hospitals, nursing homes, or clinics a dime. As then-Senators Kohl and DeWine explained in a bipartisan.2003 letter to the Defense Department, putative GPO “savings” are nothing more than discounts from list prices, which no one pays.

Editor: Check it out

PZ: GPOs hire academics and consulting firms to produce “sponsored research studies” claiming that they save billions for hospitals. There is, however, absolutely no independent evidence that GPOs save hospitals, nursing homes, or clinics a dime. As then-Senators Kohl and DeWine explained in a bipartisan.2003 letter to the Defense Department, putative GPO “savings” are nothing more than discounts from list prices, which no one pays.

Editor: Check it out

|

"There is absolutely no independent evidence that GPOs save hospitals, nursing homes, or clinics a dime."

|

YS: If GPOs are getting paid a percentage of the sale by the supplier, then does it sound like a good recipe for getting the best price?”

PZ: No. It guarantees that patients, hospitals, insurers, and federal health care payors and ultimately taxpayers will pay the HIGHEST prices. |

|

YS: GPOs they tend to be generations behind the cutting edge of technology. Why is this allowed?

PZ: By favoring dominant suppliers, which are able to pay the biggest kickbacks for single and bundled products, GPOs have undermined innovation and competition in the medical device and software sector. Examples abound in the Senate Antitrust hearings. Prominent examples are Retractable Technologies (safer needles), and Rochester Medical (catheter that reductions infections). They’ve all had to get major media coverage, testify before Congress, and/or file antitrust lawsuits to break into the market. More details on website. It’s hard to measure the impact of the GPO barrier in discouraging entrepreneurs and inventors to develop innovative medical technologies in the first place. It’s allowed because the GPO/hospital lobby and their allies have bought and/or intimidated the United States Congress. |

"By favoring dominant suppliers, which are able to pay the biggest kickbacks for single and bundled products, GPOs have undermined innovation and competition in the medical software and device sector."

|

YS: Close to 99% of all hospitals utilize a GPO. Is it OK for GPOs to restrict hospitals from operating outside the GPO?

PZ: Big GPO shareholder facilities stick with their GPOs because they and/or their executives get share backs. These are for-profit entities. The GPOs make more money by increasing volume and prices. All of the perverse financial incentives in the supply chain push prices higher, not lower. Hospitals don’t really care because govt payors increase reimbursement and insurers raise premiums.

As the late Bill Bandy, CEO of a Texas-based regional medical supply distribution firm used to say, the share backs, (aka patronage fees) are nothing more than a “partial refund of a deliberate overcharge."

Smaller, non-GPO shareholder facilities, as well as shareholder facilities, that sever their GPO relationships have found that they can get better deals on their own. I’ve included some examples in my safe harbor cost analysis. I understand that increasing numbers of IDNs are doing their own buying.

Executives of many non-shareholder facilities don’t understand their own costs. Others are captives to inertia; they may know they’re paying too much under GPO contracts but don’t want to go to the trouble of hiring savvy purchasing agents who can get better deals. See this research paper by a Piper Jaffray Wall St. analyst who’s a bear on Premier Inc (PINC).

Editor: Check It Out

See also “How the GPOs Inflate Healthcare $$$ page of our website: https://www.physiciansagainstdrugshortages.com/gpos-inflate-hc-costs.html.

PZ: Big GPO shareholder facilities stick with their GPOs because they and/or their executives get share backs. These are for-profit entities. The GPOs make more money by increasing volume and prices. All of the perverse financial incentives in the supply chain push prices higher, not lower. Hospitals don’t really care because govt payors increase reimbursement and insurers raise premiums.

As the late Bill Bandy, CEO of a Texas-based regional medical supply distribution firm used to say, the share backs, (aka patronage fees) are nothing more than a “partial refund of a deliberate overcharge."

Smaller, non-GPO shareholder facilities, as well as shareholder facilities, that sever their GPO relationships have found that they can get better deals on their own. I’ve included some examples in my safe harbor cost analysis. I understand that increasing numbers of IDNs are doing their own buying.

Executives of many non-shareholder facilities don’t understand their own costs. Others are captives to inertia; they may know they’re paying too much under GPO contracts but don’t want to go to the trouble of hiring savvy purchasing agents who can get better deals. See this research paper by a Piper Jaffray Wall St. analyst who’s a bear on Premier Inc (PINC).

Editor: Check It Out

See also “How the GPOs Inflate Healthcare $$$ page of our website: https://www.physiciansagainstdrugshortages.com/gpos-inflate-hc-costs.html.

"Big GPO shareholder facilities stick with their GPOs because they and/or their executives get share backs aka patronage fees."

YS: The 1987 passage of the Anti-Kickback Statute, paved the way for the administration fees GPOs collect from suppliers. This fee in the form of a percentage based on sales revenue, so where is the incentive to negotiate a better price for the hospitals?

PZ: Thanks to the safe harbor, the GPOs have no incentive to negotiate better prices for hospitals.

YS: Smaller manufacturers and smaller providers have more difficulty in working with GPOs as their fees are less. What can incentivize GPOs to work with small businesses?

PZ: The only incentive GPOs have to work with small businesses is the prospect of unfavorable publicity, antitrust lawsuits, or congressional investigations. That’s what drove GPOs to work with some small medical device makers back in the early 2000s. Left to their own devices, so to speak, the GPOs, as for-profit entities, will always do whatever it takes to generate the most income, not what is best for patients.

PZ: Thanks to the safe harbor, the GPOs have no incentive to negotiate better prices for hospitals.

YS: Smaller manufacturers and smaller providers have more difficulty in working with GPOs as their fees are less. What can incentivize GPOs to work with small businesses?

PZ: The only incentive GPOs have to work with small businesses is the prospect of unfavorable publicity, antitrust lawsuits, or congressional investigations. That’s what drove GPOs to work with some small medical device makers back in the early 2000s. Left to their own devices, so to speak, the GPOs, as for-profit entities, will always do whatever it takes to generate the most income, not what is best for patients.

|

"The only incentive GPOs have to work with small businesses is the prospect of unfavorable publicity, antitrust lawsuits, or congressional investigations."

|

YS: Safe Harbor provision requires GPOs to report annual administrative fees to consumers, yet why are consumers are hard-pressed to find GPO competitor data as such numbers aren't publicly reported?

PZ: The safe harbor provision does NOT require GPOs to report admin fees to consumers. There is no systematic way to collect this data, and the GPOs lobby hard to keep it that way. It calls for them to report amounts paid by vendors to their member facilities, and to HHS on request, as stated below in the 1991 rules: (j) Group purchasing organizations. As used in section 1128B of the Act, "remuneration" does not include any payment by a vendor of goods or services to a group purchasing organization (GPO), as part of an agreement to furnish such goods or services to an individual or entity as long as both of the following two standards are met: |

The GPO must have a written agreement with each individual or entity, for which items or services are furnished, that provides for either of the following:

(i) The agreement states that participating vendors from which the individual or entity will purchase goods or services will pay a fee to the GPO of 3 percent or less of the purchase price of the goods or services provided by that vendor.

(ii) In the event the fee paid to the GPO is not fixed at 3 percent or less of the purchase price of the goods or services, the agreement specifies the amount (or if not known, the maximum amount) the GPO will be paid by each vendor (where such amount may be a fixed sum or a fixed percentage of the value of purchases made from the vendor by the members of the group under the contract between the vendor and the GPO).

(2) Where the entity which receives the good or service from the vendor is a health care provider of services, the GPO must disclose in writing to the entity at least annually, and to the Secretary upon request, the amount received from each vendor with respect to purchases made by or on behalf of the entity.

For purposes of paragraph (j) of this section, the term group purchasing organization (GPO) means an entity authorized to act as a purchasing agent for a group of individuals or entities who are furnishing services for which payment may be made in whole or in part under Medicare or a State health care program, and who are neither wholly-owned by the GPO nor subsidiaries of a parent corporation that wholly owns the GPO (either directly or through another wholly-owned entity).

The hospitals are not required to disclose this information. Further, a 2012 GAO report, requested by three U. S. senators, found that the HHS IG had failed to exercise its oversight authority over the previous eight years. That report appears on the “Govt Documents” page of our site.

(i) The agreement states that participating vendors from which the individual or entity will purchase goods or services will pay a fee to the GPO of 3 percent or less of the purchase price of the goods or services provided by that vendor.

(ii) In the event the fee paid to the GPO is not fixed at 3 percent or less of the purchase price of the goods or services, the agreement specifies the amount (or if not known, the maximum amount) the GPO will be paid by each vendor (where such amount may be a fixed sum or a fixed percentage of the value of purchases made from the vendor by the members of the group under the contract between the vendor and the GPO).

(2) Where the entity which receives the good or service from the vendor is a health care provider of services, the GPO must disclose in writing to the entity at least annually, and to the Secretary upon request, the amount received from each vendor with respect to purchases made by or on behalf of the entity.

For purposes of paragraph (j) of this section, the term group purchasing organization (GPO) means an entity authorized to act as a purchasing agent for a group of individuals or entities who are furnishing services for which payment may be made in whole or in part under Medicare or a State health care program, and who are neither wholly-owned by the GPO nor subsidiaries of a parent corporation that wholly owns the GPO (either directly or through another wholly-owned entity).

The hospitals are not required to disclose this information. Further, a 2012 GAO report, requested by three U. S. senators, found that the HHS IG had failed to exercise its oversight authority over the previous eight years. That report appears on the “Govt Documents” page of our site.

YS: Pharmacy Benefit Managers administer the prescription drugs benefit of health insurance plans. How have they contributed to high cost of drugs in the US?

PZ: In 2003, HHS IG quietly and inexplicably extended the GPO safe harbor to cover PBM rebates (which are nothing more than post-sale kickbacks), giving rise to an unceasing upward spiral in the prices of drugs sold to individuals through PBMs. See HHS IG compliance document of 4/03, pp.24-25.

Editor: Check It Out

PZ: In 2003, HHS IG quietly and inexplicably extended the GPO safe harbor to cover PBM rebates (which are nothing more than post-sale kickbacks), giving rise to an unceasing upward spiral in the prices of drugs sold to individuals through PBMs. See HHS IG compliance document of 4/03, pp.24-25.

Editor: Check It Out

|

YS: Why was there a saline shortage after Hurricane Maria?

PZ: Saline solution was in short supply for years before Hurricane Maria, as the FDA drug shortages database (and the UUDIS database) will show. My understanding is that before the hurricane, we were importing saline from Spain, Germany and Norway. After the storm, we had to import it from at least another four countries. To be sure, Maria exacerbated the existing shortages. But Maria gets a bad rap. The real reason for the saline shortages, like the shortages of hundreds of other drugs, is that the GPOs have awarded Baxter and other favored suppliers’ exclusive contracts. There is no data base where you can review contract terms or fees. But occasionally, as in this instance, the GPO or manufacturer issues a press release boasting of the award! See attachment below. |

"The real reason for the saline shortages, like the shortages of hundreds of other drugs, is that the GPOs have awarded Baxter and other favored suppliers’ exclusive contracts."

|

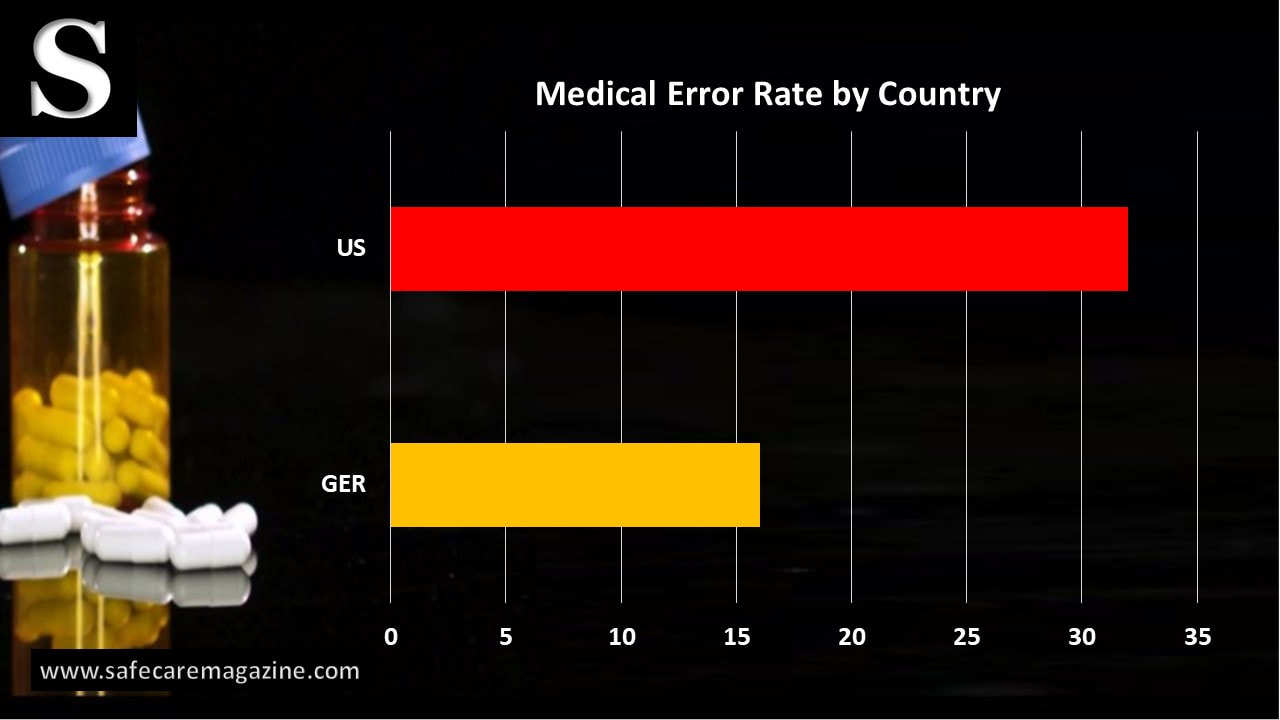

YS: Today, medical errors are the third leading cause of deaths in the US, and cost is soaring, should Congress take a second look at this “Safe Harbor" from federal statutes?

PZ: There is little doubt that corrupt, anticompetitive GPO contracting and pricing practices are responsible for some percentage of medical errors. The only way to end the shortages and outrageous prices of drugs, supplies, and devices is to restore market competition and integrity to the supply chain. And the only way to do that is to repeal the AKS safe harbor for GPOs and PBMs.

Sen. Kohl and DeWine drafted this “Discussion Draft” bill in 2005, but it never made it out of the Antitrust Subcommittee because of opposition by the GPOs, the AHA, aided by Sen. Chuck Schumer. Editor: See the highlighted section: https://nebula.wsimg.com/c99adc9e677ccde51187b87fa5de42a7?AccessKeyId=62BC662C928C06F7384C&disposition=0&alloworigin=1.

In 2017, after meeting with me and two of our physician members, Rep. Mark Meadows resurrected the bill and promised to introduce it. He reneged, claiming that the Heritage Foundation didn’t support it. The Heritage Foundation appeared to know nothing about this: Read the Meadows bill. If you want to pursue this angle, I’ll forward to you the email we received from Meadows’s staffer. Note: Spelling is Meadows, not Meadow, as it appears on bill.

Editor: Check It Out

PZ: There is little doubt that corrupt, anticompetitive GPO contracting and pricing practices are responsible for some percentage of medical errors. The only way to end the shortages and outrageous prices of drugs, supplies, and devices is to restore market competition and integrity to the supply chain. And the only way to do that is to repeal the AKS safe harbor for GPOs and PBMs.

Sen. Kohl and DeWine drafted this “Discussion Draft” bill in 2005, but it never made it out of the Antitrust Subcommittee because of opposition by the GPOs, the AHA, aided by Sen. Chuck Schumer. Editor: See the highlighted section: https://nebula.wsimg.com/c99adc9e677ccde51187b87fa5de42a7?AccessKeyId=62BC662C928C06F7384C&disposition=0&alloworigin=1.

In 2017, after meeting with me and two of our physician members, Rep. Mark Meadows resurrected the bill and promised to introduce it. He reneged, claiming that the Heritage Foundation didn’t support it. The Heritage Foundation appeared to know nothing about this: Read the Meadows bill. If you want to pursue this angle, I’ll forward to you the email we received from Meadows’s staffer. Note: Spelling is Meadows, not Meadow, as it appears on bill.

Editor: Check It Out

YS: Thank you Phil for a lifetime of campaigning to restore market competition and integrity to the supply chain by highlighting the kickbacks, rebates, bribes, and other abuses of group purchasing organizations.